does square cash app report to irs

However although there was much fuss online and in the news that everyones. Square is required to issue a Form 1099-K and report to the state when 600 or more is processed in card payments.

Solved Your First Tax Season With Square The Seller Community

The IRS has issued a new regulation that requires all third-party payment applications to report company revenues of 600 or more to the IRS using a 1099-K form beginning January 1 2022.

. Certain Cash App accounts will receive tax forms for the 2018 tax year. VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for. As of January 1 2022 there are new rules for cash apps and electronic payment systems to report business transactions to the IRS.

Tax Reporting for Cash App. E-filing is free quick and secure. With a cash app small businesses farmers market vendors and hair stylists to name a few are able to accept payments in a more modern way than writing.

Similarly one may ask does Cashapp report to IRS. People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. Now Cash App and other third-party payment apps are required to report a users business transactions to the IRS if they exceed 600 annually.

Does cash APP report to IRS. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. Starting January 1 2022 the American Rescue Plan Act of 2021 requires services like Cash App to report payments for goods and services on Form 1099-K when those transactions total 600.

This means any sales made through Cash App formerly Square PayPal Venmo or other third-party platform will result in a 1099-K form next year. If you have sold Bitcoin during the reporting tax year Cash App will provide you with a 1099-B form by February 15th of the following year of your Bitcoin sale. Cash App is required by law to file a copy of the Form 1099-B to the IRS for the applicable tax year.

2022 the rule changed. And the IRS website says. These reporting thresholds are based on the aggregate gross sales volume processed on all accounts using the same Tax Identification Number TIN.

How do I move apps to the system priv app. Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. However this means that the IRS is catching up to it to wring tax money out of this lucrative market.

PLEASE CONTACT CUSTOMER SERVICE AT 1-855-351-2274 OR IN THE SQUARE CASH APP. The IRS requires Square to report every account that meets the Form 1099-K requirementsincluding non-profits. An FAQ from the IRS is available here.

Answer 1 of 3. A person can file Form 8300 electronically using the Financial Crimes Enforcement Networks BSA E-Filing System. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service.

Does Cash App Report Your Transactions to The IRS. All financial processors are required to report credit card sales volume and then issue a 1099K I think its a K for that amount so that gets automatically reported to the IRS. A Bit of Background About Cash App.

By Tim Fitzsimons. Lets go into a bit more detail on what kinds of transactions the IRS will expect Cash App to report. Do I qualify for a Form 1099-B.

Cash App initially released in 2013 but it did not add Bitcoin support until about five years later. Cash sales would b. A business transaction is defined as payment.

In the past few years many small businesses have embraced the use of digital payment platforms. Cash App does not provide tax advice. It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App.

I believe they would have to get a warrant or supena or court order of some sort. If you have multiple accounts that use the same TIN we will aggregate the. What does the app stack app do.

However in Jan. Here are some facts about reporting these payments. Filers will receive an electronic acknowledgement of each form they file.

The IRS requires Payment Settlement Entities such as Square to report the payment volume received by US. 1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. Tax Reporting with Cash For Business.

So what does Cash App report to the IRS. As a merchant or individual you need to know the IRS rules for reporting cash app income. 10 Reasons Why Cash App Can Close Your Account.

Cash App for Business accounts that accept over 20000 and more than 200 payments per calendar year cumulatively with Square will receive a Form 1099-K. There have been major changes in the way companies are required to report the sale of goods andor services through P2P payment services such as Cash App.

Form 1099 K Tax Reporting Information Square Support Center Us

Solved Your First Tax Season With Square The Seller Community

Falcon Expenses Expense Report Template Expense Tracker Mileage Tracker App Tracking Mileage

Irs To Start Taxing Certain Money Transfer App Users Nbc2 News

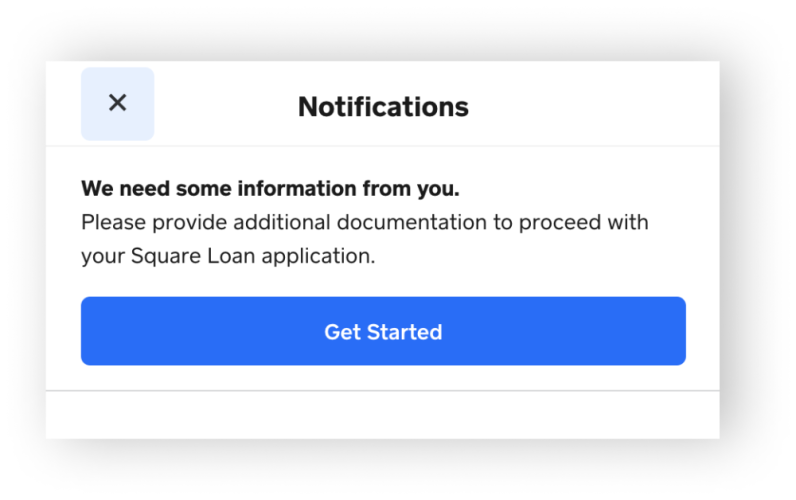

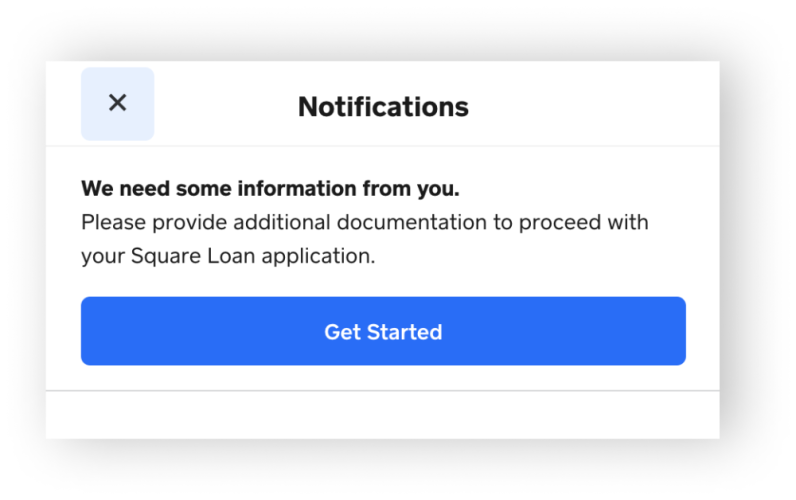

Information Requested For Square Loan Application Faq Square Support Center Us

Does The Irs Want To Tax Your Venmo Not Exactly

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

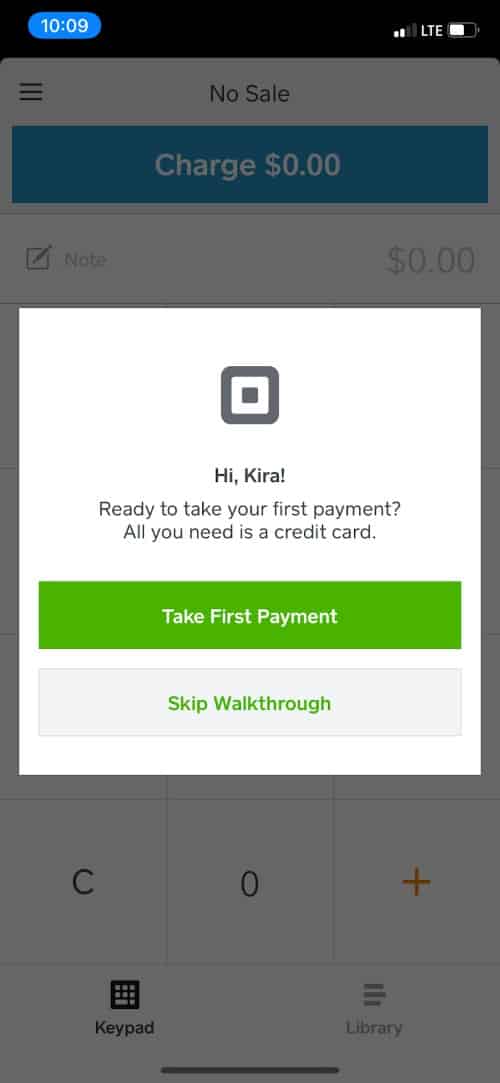

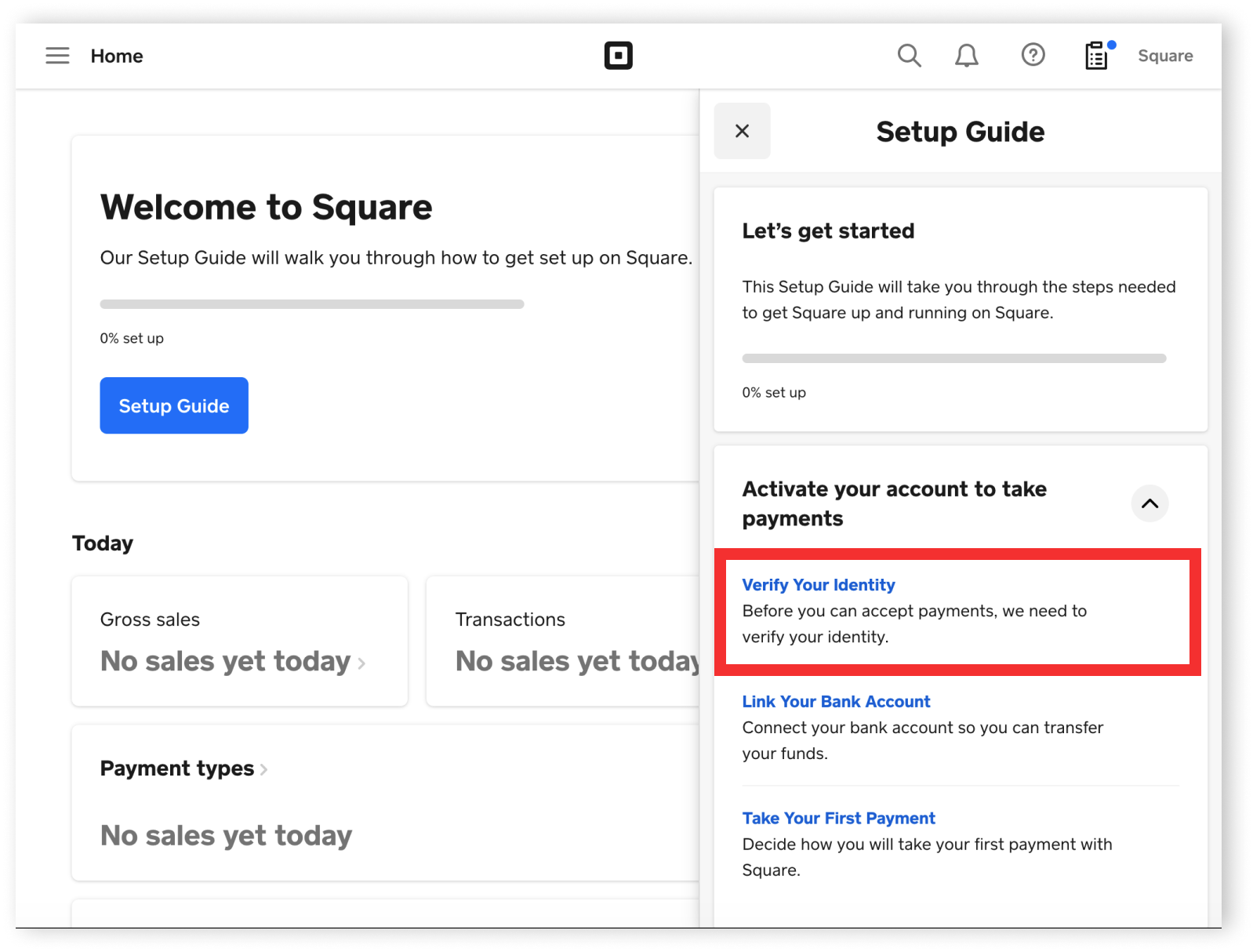

The Ultimate Square Pos Setup Guide

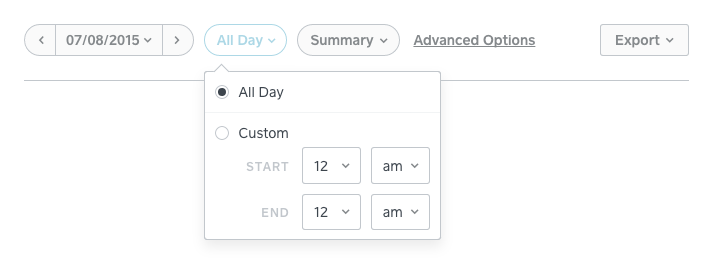

Summaries And Reports From The Online Square Dashboard Square Support Center Us

How Does Paypal Venmo Zelle Stripe And Square Report Sales To The Irs Will You Receive A Tax Form 1099 K For 2019 By Steph Wynne Medium

New Tax Law Sell More Than 600 A Year Venmo Paypal Stripe And Square Must Report Your Income To The Irs Gobankingrates

Required Documentation For Sign Up Square Support Centre Ie

Square S Cash App Vulnerable To Hackers Customers Claim They Re Completely Ghosting You

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Solved Everything You Need To Know About 1099 K Tax Forms Page 2 The Seller Community

Square S Cash App Launches Apparel Collection Pymnts Com

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You